Not known Details About Hsmb Advisory Llc

Table of Contents8 Easy Facts About Hsmb Advisory Llc DescribedHsmb Advisory Llc Fundamentals ExplainedFascination About Hsmb Advisory LlcGetting The Hsmb Advisory Llc To WorkAn Unbiased View of Hsmb Advisory LlcAll About Hsmb Advisory Llc

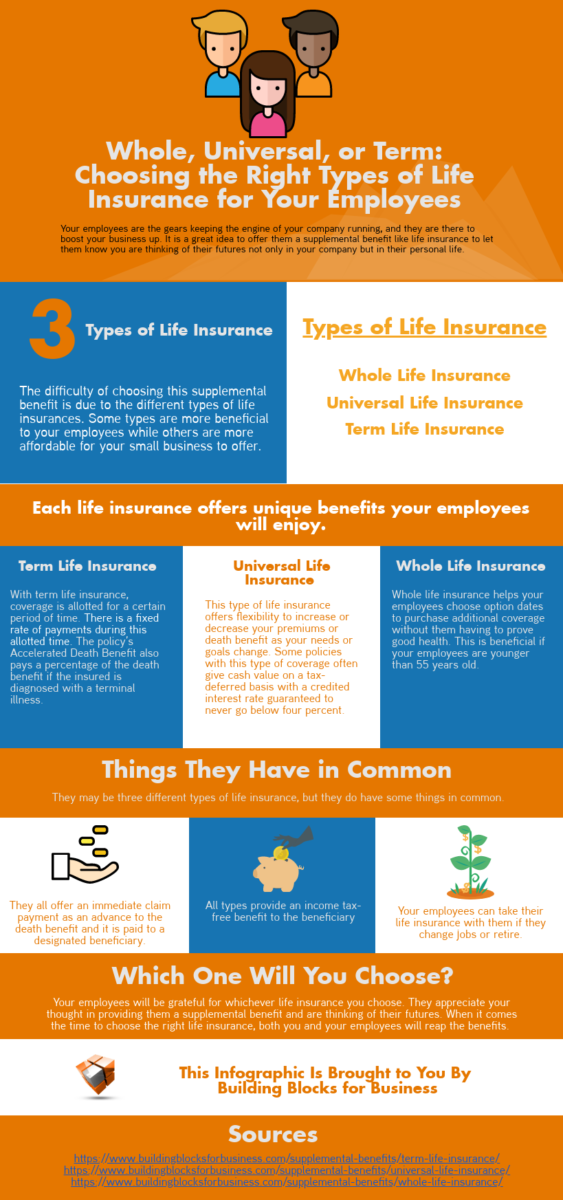

Ford claims to stay away from "money value or permanent" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are extremely made complex, featured high payments, and 9 out of 10 people do not need them. They're oversold due to the fact that insurance coverage representatives make the biggest commissions on these," he says.

Special needs insurance coverage can be expensive. And for those who go with long-term care insurance, this plan may make disability insurance unnecessary. Review extra concerning long-lasting treatment insurance coverage and whether it's ideal for you in the next section. Lasting treatment insurance policy can assist spend for expenditures connected with long-term treatment as we age.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

If you have a persistent health issue, this sort of insurance coverage can wind up being essential (Health Insurance St Petersburg, FL). Nevertheless, don't let it emphasize you or your checking account early in lifeit's normally best to obtain a policy in your 50s or 60s with the expectancy that you won't be utilizing it till your 70s or later on.

If you're a small-business proprietor, think about protecting your source of income by acquiring company insurance policy. In case of a disaster-related closure or period of restoring, company insurance policy can cover your income loss. Think about if a substantial weather condition event affected your store or manufacturing facilityhow would that influence your earnings? And for the length of time? According to a report by FEMA, in between 4060% of local business never ever reopen their doors adhering to a catastrophe.

Plus, using insurance could often set you back even more than it conserves in the future. If you get a chip in your windscreen, you might think about covering the repair work expense with your emergency savings rather of your auto insurance policy. Why? Because using your car insurance policy can create your month-to-month costs to rise.

4 Simple Techniques For Hsmb Advisory Llc

Share these ideas to safeguard loved ones from being both underinsured and overinsuredand talk to a relied on expert when needed. (https://fl-saint-petersburg.cataloxy.us/firms/hsmbadvisory.com.htm)

Insurance coverage that is acquired by a specific for single-person coverage or insurance coverage of a family. The specific pays the costs, in contrast to employer-based medical insurance where the company often pays a share of the premium. Individuals may purchase and acquisition insurance coverage from any plans readily available in the person's geographical visit this web-site region.

People and households may qualify for economic assistance to decrease the expense of insurance coverage costs and out-of-pocket prices, yet only when enrolling through Connect for Health Colorado. If you experience particular modifications in your life,, you are qualified for a 60-day duration of time where you can enroll in an individual strategy, also if it is outside of the yearly open registration duration of Nov.

15.

It may appear basic but recognizing insurance coverage types can also be puzzling. Much of this complication comes from the insurance sector's ongoing goal to create tailored insurance coverage for insurance holders. In designing flexible policies, there are a selection to select fromand all of those insurance policy types can make it difficult to comprehend what a specific policy is and does.

The Single Strategy To Use For Hsmb Advisory Llc

If you pass away during this period, the individual or people you have actually named as recipients may get the cash money payment of the plan.

However, several term life insurance policy plans let you convert them to a whole life insurance policy policy, so you do not shed coverage. Usually, term life insurance policy plan premium payments (what you pay per month or year right into your policy) are not secured at the time of purchase, so every 5 or 10 years you have the policy, your premiums could rise.

They additionally often tend to be less expensive general than entire life, unless you acquire a whole life insurance policy when you're young. There are likewise a couple of variants on term life insurance policy. One, called team term life insurance policy, prevails amongst insurance coverage options you may have access to with your company.

Getting My Hsmb Advisory Llc To Work

This is usually done at no expense to the worker, with the capability to buy additional coverage that's secured of the staff member's paycheck. An additional variation that you could have access to with your employer is supplemental life insurance coverage (Insurance Advisors). Supplemental life insurance policy might include unintentional fatality and dismemberment (AD&D) insurance, or interment insuranceadditional coverage that could help your family members in case something unexpected happens to you.

Permanent life insurance policy merely refers to any life insurance coverage policy that does not expire.